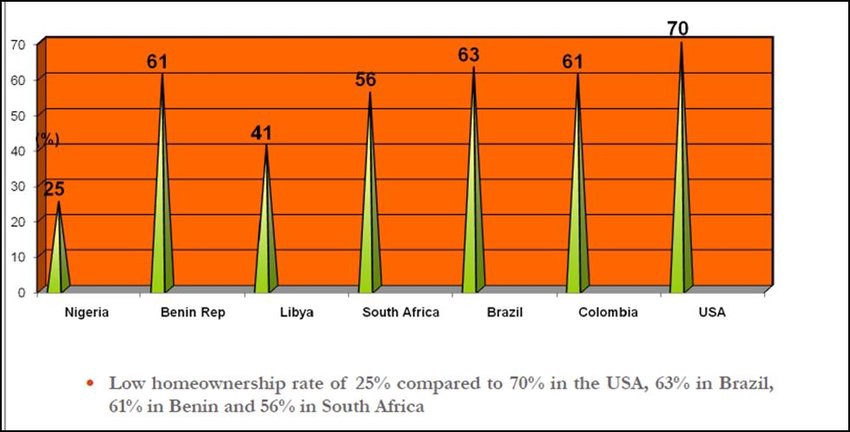

Nigeria’s rising housing deficit is now more an emergency than news. With the deficit estimated to be at a staggering 20 million units, homeownership rate in Nigeria stands at a dismal 25% compared to the reality in countries like Indonesia (84%), Kenya (73%) and South Africa (56%), respectively.

Lagos, as the most populous city in Nigeria, is at the center experiencing this housing problem more than any other state. Due to the huge demand, quick fixes abound; the building of houses that are inhabitable and do not meet modern standards or building of houses in slums, which pose health risks to inhabitants of such areas. This housing problem has also led to the building of houses that do not suit city plans, leading to frequent demolitions, which leave more people unhoused, poorer, and further compounding the issue.

In solving the challenge, private real estate developers have stepped to the plate to provide a well-rounded and lasting approach to the issue of housing in Nigeria. Much of their approach has been holistic and geared towards lasting and sustainable solutions. For the most part, these private property developers adhere to government regulations while carrying out property construction to provide houses that are not only safe and habitable but also have eye-catching designs.

This approach has not been without challenges. As is common in cities with inadequate infrastructure, like Lagos, efforts to fix the housing deficit have given rise to other challenges that are unique to estate and facility management. One of these is that many homes are built without consideration to the market’s needs, resulting in low occupancy rates in many estates around Lagos, as the average working professional cannot afford to pay for them. The attendant effect of this is that the developers incur costs managing them without generating any revenue on these buildings.

Another problem encountered with estate facility management in Lagos involves poor electricity and water supply. Lagos State being a sample size of Nigeria, it is no surprise that the same infrastructural challenges faced at the national level are common occurrences as well. There is a peculiarity with Lagos though, as residents who pay more to settle in highbrow estates expect they should not experience any issues with social infrastructure or amenities.

But sometimes, estimated bills from electricity distribution companies do not tally with what is supplied, which usually leads to total disconnection. In other cases, the collapse of public infrastructure leads to flooding. Residents of such areas have been known to revolt, with the estate developers having no choice but to find alternative means of power supply or self-fund infrastructure.

A classic example of this is at the Ocean Bay Estate around the Lafiaji community on the Lagos-Epe expressway, Lagos. The developer of the estate, Octo5 Holdings, says it has chosen to take a proactive approach to make sure the estate continues to be a wholesome community for residents. Despite agreeing that wear and tear might have affected the estate, which was built in 2003, Octo5 Holdings, according to its CEO, Mr Jide Odusolu, has invested over N150 million in various infrastructure projects to uplift the façade of the estate and provide adequate, water, power and road infrastructure for residents of Ocean bay Estate.

These include the provision of water treatment facilities, a Gas-fueled captive power plant, and the construction of storm drainage systems to address flooding issues which are rampant on the Lekki Peninsula. Octo5 Holdings says that these investments are considered critical, as its goal is to build conducive communities for residents and create jobs in host communities.

These types of investments in the construction and real estate sector can deliver positive impacts to people and communities by creating economic opportunities, enabling inclusive urbanization and fostering environmental sustainability, according to the CDC Group, the UK’s development finance institution. For a country like Nigeria with an infrastructure gap estimated at about $3trn, six times the size of its annual GDP, private-sector-led investments such as this not only support residents of the immediate community but aid in solving larger economic challenges like poverty and job creation.